Cybercriminals spoofing the financial sector

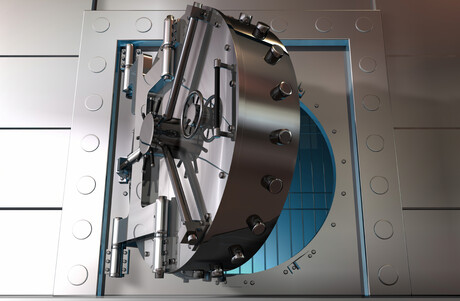

The financial services sector is a highly lucrative target for cybercriminals, and it is no surprise that it’s among the top industries targeted by cyberattacks. As the threat landscape continues to evolve, it’s increasingly challenging for banks and other financial services to keep up with sophisticated attack techniques.

New Trellix research of cybersecurity professionals highlights just how vulnerable the industry is, with 58% of financial services respondents admitting to feeling like they’re losing the battle against cybercriminals. Moreover, 56% recognise that they have blind spots in their protection today, leaving them exposed to malicious attacks.

Perhaps the most confronting finding revealing the current state of the landscape is that only 13% feel they can successfully anticipate new threats with the threat intelligence they currently receive.

The implications of spoofing

One of the most insidious tactics used by cybercriminals is spoofing, a technique that involves impersonating a legitimate entity that is often used to deceive victims into carrying out an immediate action; for example, clicking a link to ‘authenticate’ their account or to update their credit card details. The prevalence of spoofing attacks has reached alarming levels, with customers of financial institutions frequently falling prey to fraudulent schemes.

The implications of a successful spoofing attack are significant and far-reaching. They can encompass various consequences, including unauthorised access to sensitive customer data, substantial financial losses for victims, and even the potential disruption or shutdown of business operations if the situation escalates. According to recent reports, Australians lost a record $3.1 billion to scams in 2022, of which many would have included an element of spoofing.

Threats cloaked in simplicity

Spoofing is so easily deployed by cybercriminals, and the fact that it requires no special equipment means it can be up and running in minutes. Recently, Australians have become more susceptible to falling for spoofed text messages because they appear in the same text message thread as previously real messages from their banking provider. In 2022, the ACCC’s Scamwatch received 14,603 reports of bank impersonation scams, resulting in over $20 million in losses, averaging $22,000 per victim.

Rich in sensitive, personal information, financial services are a data goldmine for cybercriminals and the emotional devastation of being stripped of your life savings is becoming too well known amongst Australians. It is no longer enough for financial institutes to put up a static shield to defend against incoming attacks as malicious actors continue to be creative and constantly hunt for new routes to breach. Australia’s financial sector must be agile and adopt an approach that can flex to new threats in real time, thus blocking fraudsters in their tracks.

Strengthening defences on the front line

Establishing a robust defence system is crucial for financial services to identify and mitigate potential spoofing scams. While organisations can leverage available resources to safeguard against fraudulent impersonations, relying solely on basic security measures and antispam email filters will prove inadequate in responding swiftly to attacks.

From our research, 91% of financial sector respondents reported that they class their current security model as being siloed, meaning it comprises tools and systems that cannot communicate with each other. Security teams in the financial services sector must prioritise the utilisation of real-time detection and prevention capabilities. Having a comprehensive ecosystem that consolidates various security products into an interconnected platform not only empowers organisations to withstand attacks but also cultivates resilience against emerging threats.

By enhancing their email defence system, financial services can fortify their security posture and safeguard against both known and emerging risks, ensuring more robust protection against spoofing incidents.

Quicker and more effective responses to potential attacks

It’s time for the financial sector to take proactive measures and stay one step ahead of the relentless cybercriminals that are costing Australians their livelihoods. Embracing a holistic cybersecurity approach empowers the finance sector to instantly adapt to advancing threats, enhance correction capabilities throughout the defence life cycle, and mitigate harm to its business and customers.

How the explosion of non-human identities is changing cybersecurity

A surge in machine-to-machine communication and non-human...

Building stronger critical infrastructure with Zero Trust

Zero Trust provides a way to stay ahead of cyber attacks by assuming breaches will happen and...

Happy birthday, Active Directory!

Active Directory is a technology that has proved its staying power and has shaped enterprise IT...